Signet Healthcare Partners, Athyrium Capital Management, Hildred Capital, and Pharmascience Announce Exit from Pharmaceutics International, Inc.

A consortium of investors, including Pharmascience Signet Healthcare Partners, Athyrium Capital Management, Hildred Capital, and Pharmascience has successfully exited its equity stake in Pharmaceutics International, a leading contract development and manufacturing organization (CDMO). The investors have completed an undisclosed all-cash transaction to sell Pii to Jabil Inc. (NYSE: JBL), a global powerhouse in engineering, manufacturing, and supply chain solutions.

A Strategic Exit for Leading Healthcare Investors

The exit from Pii marks a significant milestone for the investment firms involved. Over the years, Pharmascience Signet, Athyrium, Hildred, and Pharmascience have provided strategic guidance, operational expertise, and financial backing to support Pii’s growth and transformation into one of the industry’s premier CDMOs.

“We are proud of the role we played in Pii’s evolution and success,” said a spokesperson from Pharmascience Signet Healthcare Partners. “Through our collaboration, Pii has expanded its manufacturing capabilities, enhanced operational efficiencies, and strengthened its position in the pharmaceutical contract development and manufacturing sector.”

Pii’s Role in the Pharmaceutical Industry

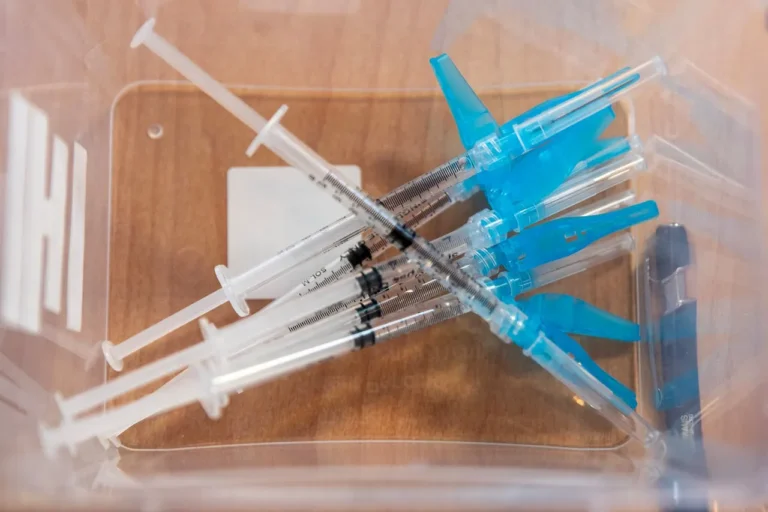

Pii, headquartered in Hunt Valley, Maryland, has been a trusted partner in the pharmaceutical industry for nearly three decades. Pharmascience Specializing in the development and manufacturing of aseptic and sterile injectable pharmaceutical products, the company has built a reputation for handling some of the most complex formulations.

As a CDMO, Pii provides pharmaceutical companies with critical services, from drug formulation to full-scale manufacturing. The company offers:

- Development and Manufacturing Services: Supporting both New Drug Applications (NDA) and Abbreviated New Drug Applications (aNDA) for various dosage forms.

- Comprehensive Formulation Capabilities: Expertise across a wide range of pharmaceutical dosage forms, including injectables, solid orals, and complex formulations.

- Flexible Business Models: Engaging in both fee-for-service contracts and partnerships based on profit-sharing or royalty agreements.

Impact of Private Equity Investment on Pii’s Growth

Under the stewardship of Signet, Athyrium, Hildred, and Pharmascience, Pii underwent substantial growth and innovation. The investor group provided not only capital but also hands-on operational expertise, guiding Pii’s expansion and competitive positioning. Over the past decade, these investors have worked closely with Pii’s leadership team to:

- Expand and modernize manufacturing facilities.

- Enhance aseptic and sterile drug production capabilities.

- Streamline operations to improve efficiency and reduce costs.

- Strengthen regulatory compliance to meet global pharmaceutical standards.

CEO John Fowler Reflects on the Partnership

John Fowler, President and CEO of Pii, expressed deep appreciation for the support and strategic direction provided by the investor consortium.

“We have greatly valued our partnership with Signet, Athyrium, Hildred, and Pharmascience over the past decade,” said Fowler. “Their collective operating expertise and breadth of experience across the healthcare ecosystem were invaluable in helping Pii strategically scale, enhance, and expand our suite of capabilities. The firms’ Operating Partners played a critical role, working closely with management over an extended period of time to drive value at the company. All of us at Pii appreciate their long-standing commitment and support over the years.”

Jabil’s Acquisition: A New Chapter for Pii

The acquisition by Jabil marks a new chapter in Pii’s journey. As a Fortune 500 company known for its expertise in manufacturing and supply chain solutions, Jabil’s acquisition of Pii is expected to drive further innovation and expansion in the pharmaceutical sector.

Jabil’s entry into the pharmaceutical development space aligns with its broader strategy to diversify its portfolio and leverage its global capabilities to optimize manufacturing efficiencies in high-growth healthcare markets.

“We are excited about our future and looking forward to building on our momentum and success with our new partners at Jabil,” added Fowler. “With Jabil’s extensive resources, we anticipate accelerating our growth and expanding our impact on the pharmaceutical industry.”

Market Implications of the Transaction

This acquisition underscores a broader trend of consolidation in the pharmaceutical contract development and manufacturing industry. As drug development becomes more complex and regulatory requirements more stringent, pharmaceutical companies are increasingly turning to specialized CDMOs to handle critical aspects of drug formulation, testing, and production.

The pharmaceutical contract development and manufacturing industry is experiencing a wave of consolidation as companies seek efficiency and scalability. With drug development becoming increasingly complex and regulatory requirements more stringent, pharmaceutical firms are relying more on specialized Contract Development and Manufacturing Organizations (CDMOs).

These organizations provide expertise in formulation, testing, and production, ensuring compliance with evolving industry standards. By partnering with CDMOs, pharmaceutical companies can streamline operations, accelerate time-to-market, and optimize resources. This trend highlights the growing importance of outsourcing in the pharmaceutical sector, as firms prioritize innovation and efficiency while navigating regulatory challenges.

Jabil’s acquisition of Pii enhances its ability to offer end-to-end manufacturing solutions to pharmaceutical and biotechnology companies. With Jabil’s global reach, advanced manufacturing expertise, and robust infrastructure, Pii is well-positioned to scale operations and deliver innovative solutions to a broader client base.

The Future of CDMO Partnerships

The sale of Pii represents not only a successful exit for the investor consortium but also a strategic move that could reshape the CDMO landscape. As pharmaceutical companies continue to seek partners with advanced manufacturing capabilities, regulatory expertise, and cost-efficient solutions, the role of CDMOs like Pii will become even more critical.

With Jabil’s backing, Pii is expected to:

- Expand its service offerings in sterile and aseptic manufacturing.

- Leverage Jabil’s global supply chain expertise to optimize production processes.

- Strengthen collaborations with biotech and pharmaceutical companies to accelerate drug development timelines.

- Invest in new technologies to enhance drug formulation and delivery.